From Rare Luxury to Market Normal: $1M+ Homes in the Comox Valley

In the early 2000s, a single-family home selling for more than $1,000,000 in the Comox Valley was a notable exception. These transactions were rare and often headline-worthy.

Fast forward to today, and million-dollar home sales are no longer an anomaly—they are a regular feature of the local housing market.

An analysis of MLS® data highlights just how dramatically the market has evolved.

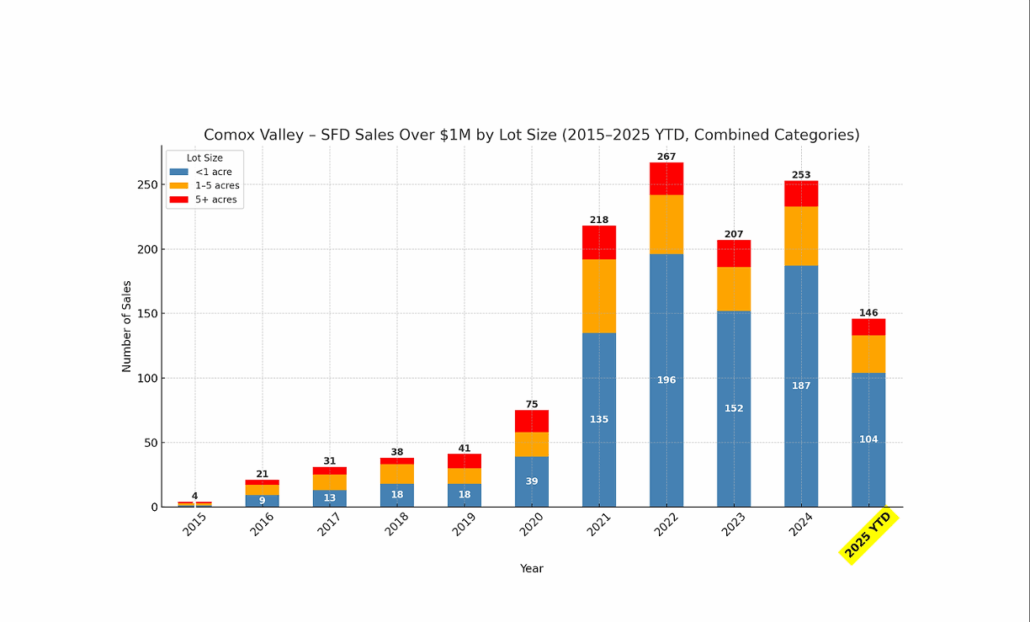

$1M+ Home Sales: A Market Transformed

- Before 2015: Annual $1M+ sales were typically in the single digits

- 2015: Just 4 homes sold above the $1M threshold

- 2021–2022: Sales surged into the hundreds each year

- 2024: A total of 253 homes sold for over $1M

- 2025 (to July 31): 146 homes have already surpassed the $1M mark

What was once considered luxury pricing has steadily become part of the market norm.

Big-Picture Forces Behind the Shift

Several broader economic and demographic trends have reshaped housing values in the Comox Valley.

Ultra-Low Interest Rates (2020–2021)

Historically low borrowing costs dramatically increased purchasing power, fuelling record-setting activity across Canadian housing markets. Bank of Canada quantitative easing further amplified liquidity and demand.

Pandemic-Era Migration

Remote work enabled buyers to prioritize lifestyle over proximity to urban employment hubs. Vancouver Island, and the Comox Valley in particular, benefited from an influx of buyers seeking space, natural amenities, and a slower pace of life.

Population Growth & Interprovincial Migration

British Columbia emerged as a top destination for retirees, professionals, and young families alike. Vancouver Island’s livability made it especially attractive.

Global Capital Reallocation

Policy changes in larger urban centres such as Vancouver and Victoria redirected capital into smaller, high-quality markets like the Comox Valley.

Local Market Drivers Accelerating Prices

In addition to macroeconomic trends, local conditions have played a major role in pushing values higher.

Limited Land Supply

With the ocean on one side and mountains on the other, developable land in the Comox Valley is naturally constrained—placing upward pressure on prices.

Highly Desirable Neighbourhoods

Areas such as Crown Isle, Comox Peninsula, and Courtenay North have become focal points for high-end custom homes and executive properties.

Rising Construction Costs

Increased material and labour costs have significantly raised replacement values, pushing both new builds and resale homes into the $1M+ range.

The Lifestyle Premium

Access to oceanfront living, alpine recreation, and a strong sense of community has positioned the Comox Valley as one of British Columbia’s most desirable “small city” markets. This has attracted higher-net-worth buyers transitioning out of larger urban centres.

A New Market Reality

The evolution of the Comox Valley housing market is clear. What was once a rare luxury has become an increasingly common expectation, reflecting long-term structural changes rather than short-term volatility.

This information was provided by Jackson & Associates, a Verra Group Valuation Affiliate, for appraisal purposes, delivering professional valuation and advisory services.

Considering Buying or Selling a $1M+ Home in the Comox Valley?

Navigating today’s high-value market requires local insight and experienced guidance. Janice Leffler, REALTOR® in the Comox Valley, understands the nuances behind pricing trends, neighbourhood values, and buyer demand in this evolving market.

Whether you’re considering selling a luxury property, moving up, or assessing your home’s current market position, Janice can help you make informed, confident decisions.

Connect with Janice Leffler today to discuss opportunities in the Comox Valley real estate market.