What Today’s Comox Valley Buyers Are Getting Right (and Wrong) in 2026

The Comox Valley real estate market in 2026 is more balanced than it has been in recent years. Buyers have more options and slightly more breathing room, but that doesn’t mean strategy doesn’t matter.

Working with buyers across Courtenay, Comox, and Cumberland, I’m seeing clear patterns in what’s working well and where some buyers are getting off track.

If you’re considering buying this year, here’s what I’m seeing on the ground.

What Buyers Are Getting Right

1. They’re Getting Pre-Approved Early

The strongest buyers are financially prepared before they start seriously looking. Pre-approval isn’t just about knowing your budget; it strengthens your offer and reduces stress when the right home comes along.

Even in a more balanced market, hesitation can cost you the home you truly want.

2. They’re Looking at Neighbourhood Fit, Not Just Price

Buyers who succeed in this market focus on lifestyle first.

- Courtenay offers convenience and schools.

- Comox appeals to buyers wanting established neighbourhoods and marina access.

- Cumberland attracts those who value character homes and trail access.

When buyers choose the right area for how they actually live, they’re happier long term, and their resale value tends to reflect that.

3. They’re Thinking Long-Term

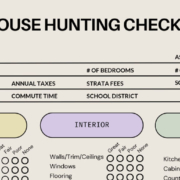

The buyers who feel most confident about their purchase are looking beyond today’s interest rates or short-term fluctuations. They’re asking:

- Will this home work for me in five years?

- Is this a neighbourhood with stable demand?

- Does this property offer long-term value?

That mindset creates better decisions.

Where Some Buyers Are Struggling

1. Waiting Too Long to Decide

More inventory has made some buyers overly cautious. While it’s smart to be thoughtful, desirable homes in established neighbourhoods still move quickly when priced correctly.

The key is balancing patience with decisiveness.

2. Focusing Only on Cosmetic Features

I’m seeing buyers fall in love with finishes and overlook fundamentals like layout, lot position, or long-term resale appeal. Cosmetic upgrades are easier to change than location or structure.

3. Assuming It’s a “Slow Market.”

The Comox Valley is balanced, not slow. Well-priced homes are still selling efficiently. Buyers who assume they can negotiate aggressively on every property are sometimes missing opportunities.

What This Means for 2026 Buyers

This market rewards preparation and clarity. It’s not about rushing, and it’s not about sitting back and waiting endlessly either.

Buyers who are having the best outcomes in 2026.:

- Understand neighbourhood dynamics

- Prepare financially

- Know their priorities

- Act confidently when the right home appears

The Comox Valley remains a highly desirable place to live. That underlying demand hasn’t disappeared; it’s simply shifted into a more strategic phase. Get in touch with me to learn more about buying a home in the Comox Valley this year!

Frequently Asked Questions About Buying in the Comox Valley

Is 2026 a good year to buy in the Comox Valley?

Yes. The market is more balanced than previous peak years, giving buyers more choice while maintaining strong long-term demand.

Are buyers negotiating more in 2026?

In some segments, yes. However, well-priced homes in desirable areas still attract strong interest.

Which area is most competitive right now?

Established neighbourhoods in Courtenay and Comox continue to see consistent activity, particularly for move-in-ready homes.

Should I wait for prices to drop?

Trying to time the market is difficult. Buyers who focus on long-term value and lifestyle fit tend to feel more confident in their decisions.

What’s the most important step before buying?

Financial preparation and understanding your priorities. Clarity makes everything else smoother.