Transitioning from tenant to homeowner can seem daunting. Today’s competitive real estate market with higher interest rates and rising prices accentuates that. However, with careful planning and an understanding of the key steps, the dream can become a reality. Here’s a comprehensive guide to help you navigate the process:

Hire the right professionals

The best way to succeed in entering the real estate market is to be well-prepared. Surround yourself with professionals, such as a real estate broker, a mortgage specialist, and a financial advisor. These experts will be able to advise you at different stages of the home-buying process. They can help you define your budget and the type of property you can afford.

Working with a Royal LePage real estate professional offers many advantages throughout this buying process. Your realtor will give you the right goods. She will guide and advise you every step of the way. She can also give you names of other key players, such as building inspectors, and legal and financial advisors. Her expertise and network can be crucial to your success.

Assess your financial situation

Analyze your borrowing capacity start by assessing your current financial situation. Calculate your income, expenses, and debts to figure out how much you can afford to borrow. Use online mortgage calculators to get an idea of your monthly payments under various scenarios.

Mortgage pre-qualification

Mortgage pre-qualification is a crucial step. It gives you a clear idea of how much you can borrow and shows sellers that you’re a serious buyer. Contact a few financial institutions or mortgage brokers to compare offers. This will help you find your best option.

Gather your down payment

Amount required

The minimum down payment in Canada is generally 5% of the purchase price for a property under $500,000. For properties between $500,000 and $1,000,000, you’ll need 5% on the first $500,000 and 10% on the remainder. For properties over $1,000,000, a minimum down payment of 20% is required.

Mortgage loan insurance

If your down payment is less than 20%, you’ll need to take out mortgage loan insurance with Sagen, the Canada Mortgage and HousingCorporation (CMHC) or Canada Guaranty. There is a premium for this insurance. It can add up to 4% of your mortgage amount and can be added to your mortgage.

Funding sources

Your down payment can come from a number of sources, including personal savings or a gift from family. There are a couple of federal programs available to help you raise this amount too. They are the HomeBuyers’ Plan (HBP) and the First Home Savings Account (FHSA).

Keep reading for more information on them.

Plan for additional costs

Land transfer taxes

Land transfer taxes vary by province and municipality and can add up. Be sure to include this calculation in your budget.

The tax is calculated on the basis of the purchase price of the property. Progressive rates are applied according to different price brackets.

For example, in BC, the property transfer tax is 1% up to $200,000, 2%between $200,000 and $2,000,000, and 3% between $2M and $3M. For over$3,000,000 there is a further 2% tax. In some jurisdictions, there are additional municipal taxes.

Transaction costs

Allow approximately 1.5% to 4% of the purchase price for transaction costs. These include closing costs, legal fees, building inspection, and prepaid adjustments, to name a few of the more common ones.

Consider homeownership assistance programs

The federal government offers some financial programs to help Canadians enter the real estate market.

● First-Time Home Buyers’ Tax Credit (HBTC): First-time homebuyers acquiring a qualifying home can claim a non-refundable tax credit of up to $1,500. The value of the HBTC is calculated by multiplying$10,000 by the lowest personal income tax rate. This credit can be claimed at the time of income tax filing following the purchase of your first property.

● Home Buyers’ Plan (HBP): The Home Buyers’ Plan (HBP) allows you to withdraw from your Registered Retirement Savings Plans (RRSPs)to buy or build a qualifying home. In its 2024 budget, the government announced an increase to the withdrawal limit from $35,000 to$60,000.

● First Home Savings Account (FHSA): Launched in April 2023, this program allows you to save up to $40,000 tax-free for the purchase of your first home. The FHSA combines elements of a Tax-FreeSavings Account (TFSA) and a Registered Retirement Savings Plan(RRSP). It allows users to make tax-deductible contributions and tax-free withdrawals from the account.

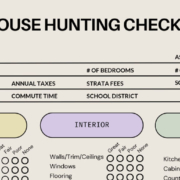

Find your dream home

Research and visits

These days, everyone can do their own property searches online. Your realtor has more precise research tools and a thorough knowledge of their local market. This gives you an advantage. She can match your needs to the right neighbourhood, and to the ideal property for you. During showings, she will be able to point out some things about the property’s

condition and possibly spot some potential problems. Most buyers will want to have a home inspection before committing to the purchase.

Make an offer

Once you’ve identified your ideal home, your realtor will prepare a competitive offer that takes into account your deadlines, budget, financing, or inspection conditions. She will represent you to the sellers and advise you on negotiating and presenting a counteroffer, if necessary.

Finalize your first home purchase

Home inspection

A thorough inspection of the property by a professional can reveal issues not visible to the naked eye. These could be structural problems, water damage, or electrical or plumbing concerns, amongst other things. Knowing about these issues in advance allows you to make an informed decision. The inspection is not intended to be a negotiating tool but to further inform you about the property you want to purchase. Depending on what is discovered, your realtor can help with further investigation.

Obtaining final financing

To obtain a mortgage, your lender will need detailed financial documentation. This includes bank statements, pay stubs, notices of assessment, and any other information on your debts and asse

Buying a home requires preparation and perseverance. By following these key steps, you can move from renter to homeowner with confidence. Consult Janice, a real estate professional, to guide you through it.

Good Luck on your path to homeownership!